Nov 30, 2025

AI agents are no longer hypothetical assistants. They are evolving into decision engines that discover, compare, and transact on behalf of users. Visa Intelligent Commerce is an infrastructure designed to enable secure, personalized, and controlled transactions when an AI agent acts for a consumer.

Legacy payments and checkout flows assume a human at the wheel. In agentic commerce that assumption breaks. Without infrastructure tailored for secure agent-mediated transactions, merchants and platforms risk friction, abandoned purchases, and compromised conversions.

This article explains the structural gap Visa is addressing, the core components of its Intelligent Commerce solution, and what this means for product, growth, and payments teams navigating the transition to AI-driven commerce.

The Challenge of Commerce in an Agentic World

Agents Are Different Buyers

AI agents do not behave like humans on a website. They identify options, compare alternatives, and execute instructions programmatically. Traditional checkout flows assume:

human navigation

manual form entry

typed credentials

sequential decision making

AI agents collapse these steps into workflows that require automation, authentication, and trust. Traditional payments rails cannot confidently authorize transactions initiated by an autonomous agent without additional safeguards.

Friction at Checkout is a Strategic Barrier

Today, even when an agent can find the right product, the transaction still depends on:

entering payment info repeatedly

navigating multiple merchant checkout experiences

manually authorizing purchases

This friction undermines agent efficiency and increases abandonment. Visa’s solution targets this structural bottleneck by enabling secure, seamless agent transactions.

Visa’s Intelligent Commerce Solution

What It Actually Is

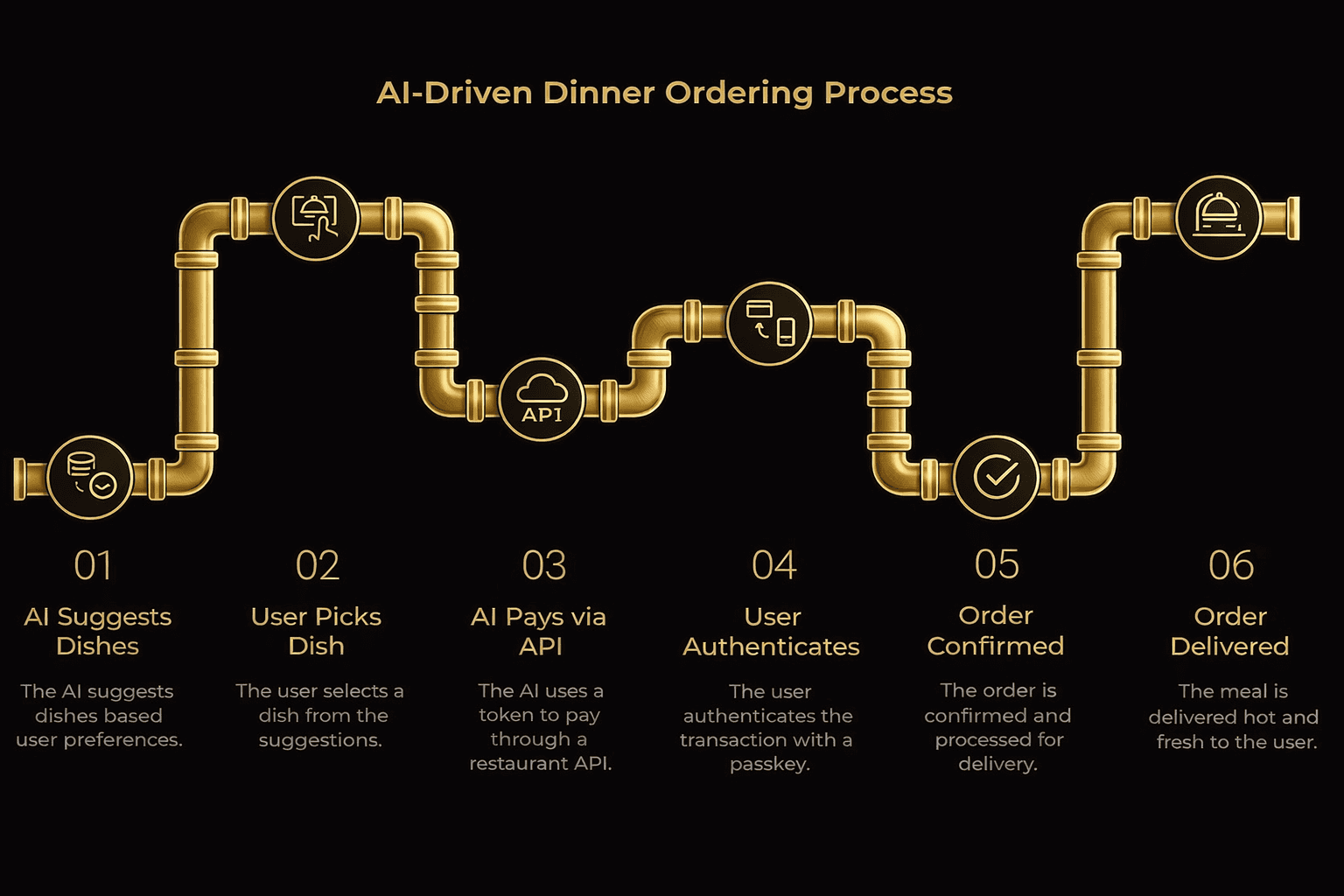

Visa Intelligent Commerce is a suite of APIs and tools that let AI agents:

Obtain agent-specific payment tokens tied to user credentials

Use personalization signals with user consent to tailor recommendations

Authenticate purchases using strong, device-based keys

Enforce consumer-controlled transaction policies

Track payment events and handle disputes programmatically

These components create a trust and control layer that enables agents to complete purchases securely and with the user’s explicit consent.

Agent-Specific Tokenization

By issuing tokens unique to each agent and merchant, Visa isolates risk and prevents replay attacks or credential reuse. Consumers never expose raw card numbers, and agents cannot deviate from pre-defined scopes.

Personalization with Consent

Agents that act with insight make better decisions. Visa’s APIs let agents use permitted signals from a user’s history to tailor recommendations while respecting privacy and user limits.

Secure Authentication

Instead of passwords or repeated card entry, Visa uses passkeys and device-based authentication to verify intent. This is faster and less error-prone for users.

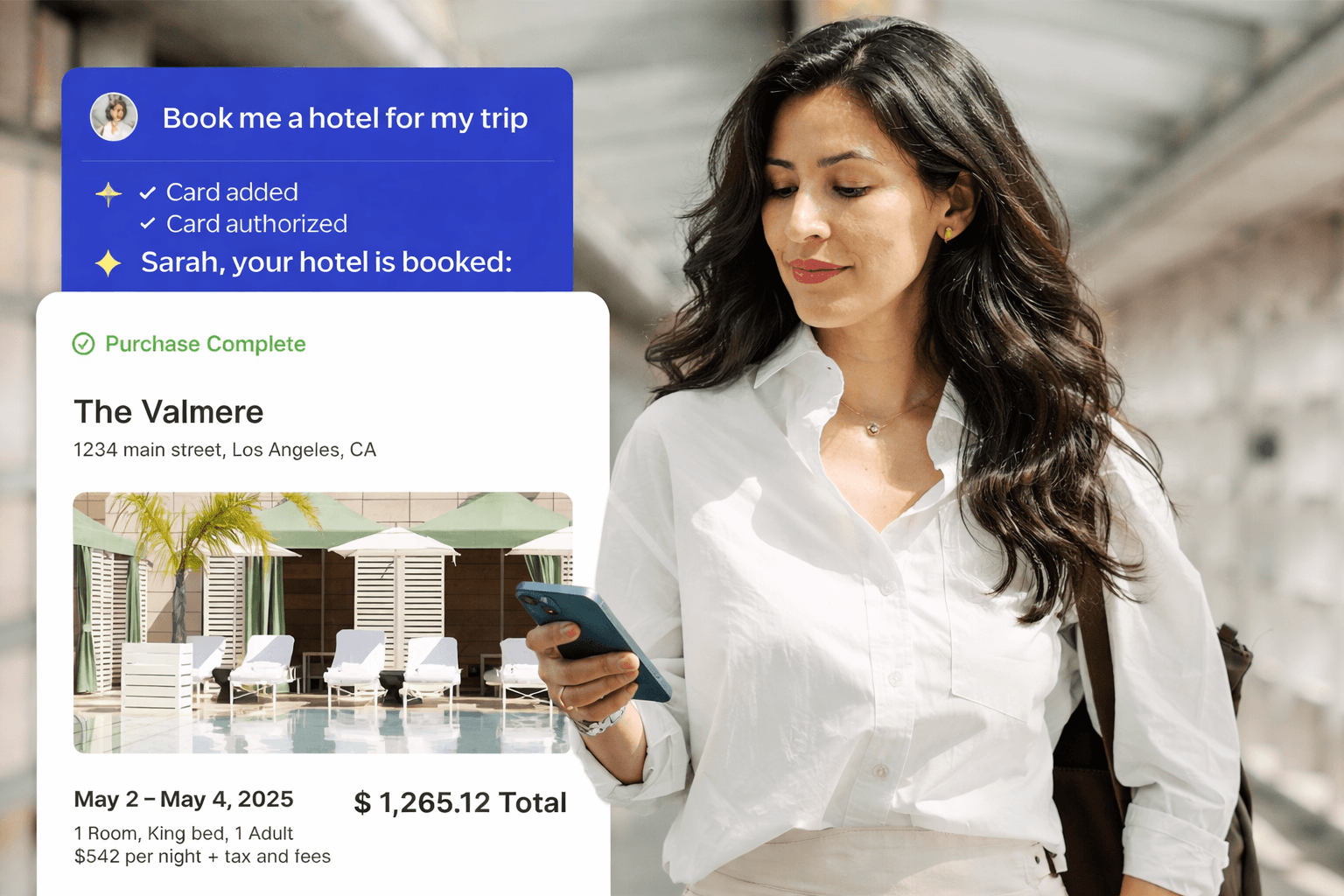

A Real-World Scenario

Julie is planning a trip. Instead of manually searching hotels, comparing prices, and entering payment details, she tells her assistant:

“I want a four-star hotel under 12,000 INR per night with a pool.”

The agent fetches options, uses personalization cues, applies her constraints, and asks her to authenticate via a secure passkey. Behind the scenes:

The agent requests a token

Visa issues a scoped token tied to Julie’s card

The agent applies consumer rules

Julie authorizes with a passkey

Visa confirms the transaction and feeds progress back

No repeated entry. No context switching. Secure and seamless.

Why Visa Intelligent Commerce Matters Now

1. AI is Already Shopping

Visa and industry data suggest a growing share of commerce signals now originate from AI agent activity, with agents handling product discovery, comparisons, and price evaluations ahead of transaction execution.

Without infrastructure that supports secure agent-initiated transactions, merchants risk losing conversions at the moment of purchase.

2. Security Cannot Be an Afterthought

Agents accelerate commerce but expose new risk vectors. Tokenization, credential isolation, and authentication controls are foundational to reducing fraud while enabling automation at scale.

3. Personalization Is Now Operational

Where personalization used to optimize recommendations, in agentic commerce it drives decisions. Agents can only be effective if they respect user preferences, limits, and identity.

Visa’s APIs make that explicit and enforceable.

Strategic Implications for Product and Growth Leaders

If you believe AI agents will influence or complete transactions at scale:

Payments and checkout cannot be an afterthought

Personalization must operate within security and consent frameworks

Analytics must surface agent-mediated conversions, not just human clicks

Teams that adopt agentic commerce infrastructure early will reduce friction and capture a larger share of AI-triggered purchase flows.

Practical Execution: What Should Teams Do Next

Map transaction flows triggered by AI agents

Identify where agents interact with discovery and checkout and quantify drop-off points.Integrate secure tokenization protocols

Implement agent-specific tokens to isolate risk and reduce friction.Adopt passkey and strong authentication mechanisms

Replace repeated entry of credentials with secure, fast user intent verification.Instrument analytics to capture agent-mediated conversions

Standard dashboards miss agent workflows. Build tracking around API events and secure transactions.Educate stakeholders

Align product, security, payments, and growth teams on the economics and risks of agentic commerce.

Visa Intelligent Commerce is not a feature set. It is an infrastructure response to the structural shift in commerce from human-driven purchase flows to agentic, automated transactions. Secure tokens, consent frameworks, authenticated intent, and personalized signals are the primitives that make this shift practical.

The teams that treat agentic commerce as a strategy, not an experiment, will lead in conversion velocity, customer experience, and growth in the era of autonomous commerce.